Tune in to our podcast series: The Dental Board Room

Listen Now

Wes Read: Welcome everybody to another episode of the Dental Boardroom podcast. As you know, every quarter I do an update on the status of the dental industry using the a DA report that they put out to the public, and I'm using AI to summarize it, which will honestly just do a much better, clear job than me on this.

It's the one area where I do use AI for a full episode. Hope you enjoy. Welcome to the deep

James: dive. Today we're pulling back the curtain on something essential, but maybe not always top of mind, the US dental economy. It's more than just checkups. It's a really vital economic sector. And we've got this comprehensive Q2 2025 report from the a D eight Health Policy Institute to guide us.

Sarah: Yeah. And it's packed with data. We're talking proprietary stuff from practices plus government sources too. It gives a pretty solid picture.

James: Exactly. So our mission here is simple, give you the shortcut to being well-informed. We'll pull out the key [00:01:00] insights, maybe some surprising facts about what's really going on in dental care right now.

Right. We'll touch on dentists economic confidence, what you, the consumer are spending, the economics inside the dental practice and, uh, the jobs market too.

Sarah: And understanding these trends. Well, it's important for almost everyone really, if you go to the dentist, if you work in healthcare, or even if you're just curious about how these essential services tick economically, we found some, uh.

Unexpected things like why are dentists feeling this quote, fiscal squeeze, even when patient spending is actually going up.

Wes Read: Hmm.

Sarah: And what are they still investing in, even with confidence apparently so low. It's a bit of a paradox.

James: Okay. Let's dive right in then. The big headline for the report, dentists Economic Confidence, it hit a new low in Q2 2025.

Sarah: Yeah, a new low and not just a little dip. It's significantly down from the start of the year.

James: And that's across the board, their own practice, the sector, the whole economy.

Sarah: That's right. All levels. They measured personal [00:02:00] practice, the dental care sector, and the wider US economy. The sentiment is pretty consistent.

James: So why, what's driving this pessimism?

Sarah: Well, the report makes it pretty clear. More dentists are skeptical than confident about the US economy overall, and they listed their top reasons. Okay. Number one, concerns about the current administration. Okay. Number two worries about tariffs.

James: Ah, tariffs. That can mean equipment.

Materials. Yeah,

Sarah: exactly. Number three, no surprise here. Rising costs inflation. Four is. Uh, just general uncertainty, too much of it. And five, uh, global instability wars, geopolitics.

James: It's quite a mix of factors.

Sarah: It really is.

James: And the report includes actual quotes, right? Mm-hmm. Someone that really stood out there is too much uncertainty with the policies and leadership.

It is difficult to operate a business with so much uncertainty.

Sarah: Yeah. You hear that frustration and another on tariffs. The state of our economy is in turmoil with the uncertainty of tariffs and the knee jerk [00:03:00] decisions made by the government daily.

James: Wow. Strong words.

Sarah: Mm-hmm. And then just the basics. Can't kept up with cost of living.

It's just a spiral. That one hits home for a lot of small businesses, I think. Yeah,

James: absolutely. But okay to be balanced. There were dentists who were feeling confident.

Sarah: Oh, definitely. The report captures that too. Their reasons sort of mirror the concerns, but from the opposite view, how so? Well, some actually like the current administration's direction, others point to the US economy.

Just being resilient, you know? Okay.

Wes Read: Some

Sarah: see the trade in tax policies positively. Some sites stable or improving economic indicators, and a big one, strong patient demand. Their schedules are full.

James: Right. Hearing both sides is key. I remember a quote like, I think the current administration is making wise plans to help strengthen our country.

Something like that.

Sarah: Yep. That was one. And another viewpoint was we are a consumer driven economy. People will grumble about prices, but continue to spend kind of a faith in the consumer

James: and that very practical one, I'm so busy, I may [00:04:00] have to turn patients away. Can't argue with that kind of demand.

Sarah: Exactly. So it's not universally gloomy. But the overall trend in sentiment is down.

James: Okay, but here's the twist you mentioned earlier. Despite this dropping confidence. Mm-hmm. They're still acting on their plans, the ones they made back at the end of 2024.

Sarah: That's what's really fascinating. The follow through is pretty remarkable considering the sentiment.

James: So what kind of plans are we talking about?

Sarah: Okay, look at this. Investing in new software, almost half. Plan two and over 40% have major equipment purchases. About a quarter planned and almost the same number, 23.8% have done it.

James: Hmm. Still spending money,

Sarah: right? And dropping insurance networks. About 20% planned and nearly 19.5% did pretty close follow through.

James: Okay,

Sarah: but here's the kicker. Adding staff, only 22% planned to add. But nearly 38% have actually done it by Q2.

James: Wow. That's much higher. Almost double the plan.

Sarah: Significantly higher. So it really suggests that, you know, whatever the economic worries [00:05:00] these practices are still investing, especially in people maybe seeing it as essential.

The confidence dip hasn't slammed the brakes on investment, at least not yet.

James: That is interesting. Okay, so dentists are worried, but acting. Let's flip to the patient side. What about consumer spending on dental care?

Sarah: Right. So in May, 2025 spending was up, but only slightly, slightly 0.4% from the month before.

James: Okay. Modest. What about longer term

Sarah: looking, bigger picture, it's up 3% for the year so far, 4% compared to a year ago. And, uh, 8% higher than just before. The pandemic started back in February, 2020. So

James: there is growth there. People are spending more on dental care than pre pandemic.

Sarah: Yes, but, and this is the crucial context, that growth is way behind overall healthcare spending.

Ah, overall healthcare spending is up 20% compared to pre pandemic physician services. Up 22%, dental is only up 8%. That's a big gap, a very big gap. It really makes you wonder. You know, are dental needs being deferred? Is insurance coverage a bigger [00:06:00] barrier here? Dental spending just isn't keeping pace with the rest of healthcare growth.

James: That's a really key takeaway. Okay, so spending is up a bit, but maybe not enough to say, make dentists feel super busy. Exactly.

Sarah: The data backs that up. Busyness levels pretty stable in Q2. About 27% of dentists said they're not busy enough.

James: Okay.

Sarah: And only 13% felt too busy. So a fair number feel they could handle more patients well

James: wait times for new patients.

Sarah: Also stable averaging just over 13 days for that first appointment, so that modest 3% spending increase. The system seems to be absorbing it easily without creating backlogs or making dentists feel rushed off their feet,

James: which leads us right into this. Fiscal squeeze concept. The report mentions, yeah.

Practices are facing pressure. What's causing it?

Sarah: It's that classic pincer movement costs going up, but revenue or rather reimbursement, not keeping pace.

James: Okay. So what costs are rising?

Sarah: Well, dental equipment and supplies. Prices are up 5% just since the start of [00:07:00] 2025. That's pretty steep for half a year.

Yeah. And staff wages. Hourly earnings for dental office staff while maybe stable the last couple of months have generally risen a bit faster than overall inflation. If you look longer term

James: and dentists are feeling this directly, oh

Sarah: yeah, they self-reported it. The majority said they saw price hikes over 5% since the start of the year for both equipment and supplies.

Wages were a bit lower, but still increasing,

James: and they expect this to continue.

Sarah: Most do. Yeah. They anticipate costs will keep climbing in the next six months, mostly in that one to 5% range for equipment, supplies, and wages.

James: Okay. So costs up, up, up. What about the other side? What They get paid reimbursement rates,

Sarah: and that's the core of the squeeze.

Those provider reimbursement rates, they nudged up slightly in May, 2025, but they're absolutely not keeping pace with overall inflation, let alone those specific practice cost increases we just talked about.

James: So the gap is widening.

Sarah: Precisely. Their costs are climbing faster than their primary revenue source.

It puts them [00:08:00] in a really tough spot financially.

James: And the consequences,

Sarah: well, one direct result. The report flags about one in four dentists said they've dropped out of some dental insurance networks. Ah,

James: which could impact patient access.

Sarah: Exactly. If your dentist is suddenly out of network, that's a real issue.

James: Okay, let's shift to jobs then. The overall US economy added what, 147,000 jobs in June? Pretty steady growth. Mm-hmm. Is the dental sector mirroring that?

Sarah: That's the expectation, right? Yeah. You see broad growth, you assume healthcare sectors are part of it, but

James: the

Sarah: dental sector is well different. A stark contrast actually.

Okay. How

James: different?

Sarah: The total number of jobs in dental offices, it's been pretty much flat recently.

James: Flat as in no growth,

Sarah: basically. Yeah. In June, 2025, it was actually down 0.2% from May for the year. So far up, only 0.2%. Same tiny increase compared to 12 months ago. It's stagnant. Wow.

James: Especially compared to the wider economy.

Why is it lack of demand? We just said spending is up slightly. [00:09:00]

Sarah: It seems less about demand and more about supply of workers. The report suggests a major factor is just how incredibly difficult it is for practices to recruit staff.

James: Still, that's been a story for a while now. Still

Sarah: very much a story.

Recruitment remains very or extremely challenging for a really high percentage of practices.

James: Any particular roles?

Sarah: Oh yes. Dental hygienists, they are by far the harvest. Get this 91.7% of practices found recruiting hygienists. Vary or extremely challenging in Q2 2025,

James: over 90%,

Sarah: and that number is actually up from 83.7% a year prior in Q2 2023.

So the hygienist recruitment challenge is getting worse, not better.

James: That's worrying for access to preventative care. What about dental assistance?

Sarah: Also challenging? About 71% found it very or extremely tough in Q2 2025, but interestingly, that's actually down from Q2 2023 when it was almost 95%.

James: So it's still hard to find assistance.

But maybe slightly less impossible [00:10:00] than it was

Sarah: kind of, yeah, a slight improvement there, but still a major hurdle.

James: The report also mentioned something about hours worked,

Sarah: right? Another small piece of the puzzle. Average weekly hours worked by dentists and staff. There's a slight downward trend, how

James: slight down

Sarah: 0.1 hours from the prior month 0.3 hours lower than the start of the year.

And down a full hour compared to 12 months ago.

James: An hour less per week on average.

Sarah: Yeah. Though context, again, it's still up 1.1 hours compared to pre pandemic levels. So they're working more than before COVID, but slightly less than they were a year ago.

James: So this flat job growth.

Sarah: Hmm.

James: Is it just the recruitment difficulty or is that economic pessimism?

Maybe making practices hesitate to hire even if they could find someone.

Sarah: That's the million dollar question, isn't it? And the report acknowledges that uncertainty. It's likely a mix of both. How much is recruitment bottleneck and how much is newfound caution due to the economic outlook? Hard to perfectly disentangle.

James: Okay, let's try and wrap this up then. Synthesize these threads, [00:11:00] the Q2 2025. Clearly shows dentists confidence is down largely thanks to worries about administration, policies, tariffs, and of course inflation.

Sarah: Mm-hmm. And the core operational challenge is that fiscal squeeze costs for everything, equipment, supplies, staff, the rising, but reimbursement rates for the actual dental care, not keeping up, not even close, really compared to inflation creates

James: real pressure.

Meanwhile, on the patient side, spending is up modestly, but it seems the system has enough capacity to handle it easily. Busyness isn't really increasing. Wait times are stable

Sarah: and average weekly hours are even ticking down slightly. Right? So the reports overall, take their assessment, looking at all this data through Q2 2025, is that the dental economy is kind of in a holding pattern.

Things aren't collapsing, but they aren't booming either, and there's potential for, as they put it, slight headwinds in the months ahead.

James: A holding pattern with potential headwinds.

Sarah: Mm-hmm.

James: Okay. [00:12:00] That leads us to a final thought, maybe something for you, our listener, to chew on. Mm-hmm. What does this fiscal squeeze on practices combined with these really persistent staffing challenges, especially for hygienists, what does that mean for the future for your access to dental care?

For its affordability in your community.

Sarah: Yeah. And how might these undercurrents, you know, this pressure within the dental world, ripple out and maybe impact the wider healthcare landscape down the road? It's something worth thinking about.

Wes knows what's best for dental practices. He's been doing this for a long time and he sees lots of practices. He can tell me how our practice is doing, and what we can do to increase our productivity. With past CPA's, there were no ideas. It was all coming from me, saying "I think I can do better, but I don't know how." I come in to meet with Wes and he says "You CAN do better, and I know how."

PracticeCFO is in hundreds of dental offices around the country. They know what numbers should look like. They know what percentages of payroll, rent and supplies should be, and they will hold you accountable to those numbers, which will really help you stick to your plan and your path of growth and savings. That is invaluable

Whenever something comes up, whether it's building or practice related and we weren't sure where the numbers would go, PracticeCFO has been instrumental in helping us figure that out. I can't say enough of how important that is - that it goes beyond that initial partnership. They make sure this business marriage works.

When I go home from work, I don't spend a whole lot of time stressing about what my books look like, or how much I owe in taxes. By using PracticeCFO, the burden of keeping track of a lot of the big financial numbers and metrics are taken off my plate.

PracticeCFO helped me develop a plan for the future. I have colleagues that work with other accountants that don't have a plan - they just look at the numbers of the practice and that's it. There's no plan for 10, 20 years from now. But with PracticeCFO, you get that. PracticeCFO makes you feel like you're they're only client.

(In reference to his practice sale) What could've been super stressful, wasn't! When picking John and Wes, it was from word of mouth recommendations and other people's experiences from the past that really did it for me. And it turns out that those recommendations were right on the line.

Wes knows the business side of dentistry. His comprehensive plan will organize your personal and professional finances so you can focus on taking care of patients. Massive ROI.

I can’t say enough good things about everyone at PracticeCFO. Everyone on the team is professional, organized, knowledgeable, helpful and kind. They also respond to emails and phone calls immediately and are always happy to help. They have helped me navigate year-to-year as a business owner. PracticeCFO gives me peace of mind that my business is in good hands.

I love Practice CFO! They have helped me obtain a practice and maintain a practice. They are incredible people who are on top of everything and make owning and running the business portion of a practice easy. They couldn’t be better for my business and my sanity. They have every detail of the business and taxes taken care of where all I have to do is show up and follow their easy steps to success!

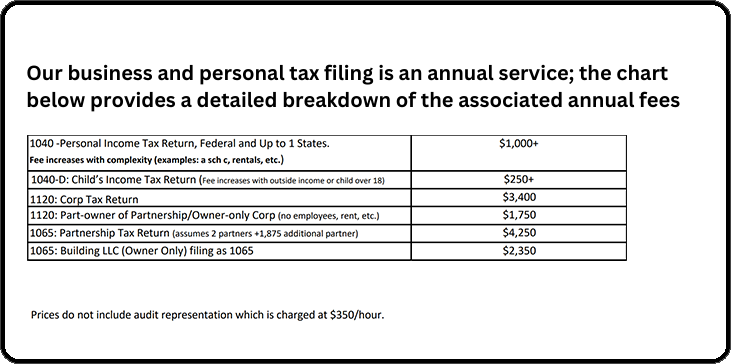

Practice CFO has the best tools I’ve seen for personal tax and financial planning in addition to top-tier corporate tax and accounting services. I have been very pleased with the level of quality service. They manage my monthly bookkeeping and accounts payable. It is a great system and saves me a ton of time, and it allows us to have monthly financial statements within a week of month end.

This will close in 0 seconds