Tune in to our podcast series: The Dental Board Room

Listen Now

Most dental practice owners enter their profession with hundreds of thousands of dollars in debt. It’s easy to feel overwhelmed by issues for your business and to therefore push aside doing personal financial planning. But goals like funding your future, eliminating debt, reducing taxes, and planning your retirement are too important to kick down the road.

PracticeCFO takes a comprehensive look at your financial picture and provides a clear strategy for accumulating wealth and navigating your financial future.

Your practice is the beating heart of your cash flow. And you want that heart to be healthy. PracticeCFO offers integrated services that optimize all aspects of your business to boost financial success. We take the guesswork out of scaling your wealth and guide you toward smart financial decisions that accelerate your success.

You’ll get proven solutions for everything from taxes and financial analysis to investments and retirement plans. These solutions will help you achieve financial independence earlier in life.

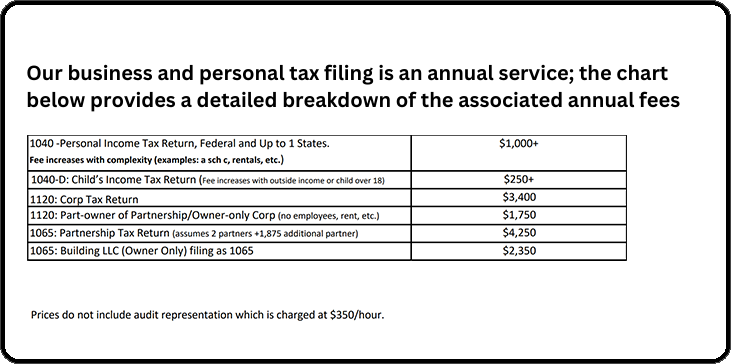

A comprehensive financial plan isn’t complete without tax planning. You need to consider your current taxes, your taxes on investments as they grow, and your future taxes that will affect the withdrawal of assets in retirement. PracticeCFO is experienced in applying legitimate but assertive tax deductions that allow you to retain more of your earnings.

Because we are involved proactively throughout the year, we make sure that all tax strategies – business and personal – are properly implemented.

As your dental practice grows, its accounting needs become more complex. It’s important for you to know the true profitability of your business. You want to be sure you’re on track to meet your financial objectives. PracticeCFO will give you detailed accounting reports each month that summarize the financial health of your practice. These reports will also allow you to compare your overhead to industry norms as well as track your progress toward specific financial goals.

Our accounting team not only reduces your administrative burdens; they also provide keen insights that can drive practice growth and profits.

Processing payroll is a critical part of running your business. Yet payroll can be complicated and expensive. Additionally, how you do payroll can affect how much you pay in taxes. If it’s not properly determined, you risk overpaying FICA taxes or becoming the subject of an IRS audit. And if your practice has a retirement plan, such as a 401k, you’ll need to determine how your compensation affects the plan funding requirements for you and your staff.

Discover effortless integration with PracticeCFO's in-house payroll system, which seamlessly integrates into your tax and financial strategies. Our comprehensive platform extends beyond basic payroll services, providing access to expert HR support, precise Time and Attendance tracking, employee geo-tracking with biometric options, work comp pay-as-you-go, quarterly webinar best practice trainings, an annual webinar covering the latest laws presented by an HR attorney, and much more!

Wes knows what's best for dental practices. He's been doing this for a long time and he sees lots of practices. He can tell me how our practice is doing, and what we can do to increase our productivity. With past CPA's, there were no ideas. It was all coming from me, saying "I think I can do better, but I don't know how." I come in to meet with Wes and he says "You CAN do better, and I know how."

PracticeCFO is in hundreds of dental offices around the country. They know what numbers should look like. They know what percentages of payroll, rent and supplies should be, and they will hold you accountable to those numbers, which will really help you stick to your plan and your path of growth and savings. That is invaluable

Whenever something comes up, whether it's building or practice related and we weren't sure where the numbers would go, PracticeCFO has been instrumental in helping us figure that out. I can't say enough of how important that is - that it goes beyond that initial partnership. They make sure this business marriage works.

When I go home from work, I don't spend a whole lot of time stressing about what my books look like, or how much I owe in taxes. By using PracticeCFO, the burden of keeping track of a lot of the big financial numbers and metrics are taken off my plate.

PracticeCFO helped me develop a plan for the future. I have colleagues that work with other accountants that don't have a plan - they just look at the numbers of the practice and that's it. There's no plan for 10, 20 years from now. But with PracticeCFO, you get that. PracticeCFO makes you feel like you're they're only client.

(In reference to his practice sale) What could've been super stressful, wasn't! When picking John and Wes, it was from word of mouth recommendations and other people's experiences from the past that really did it for me. And it turns out that those recommendations were right on the line.

Wes knows the business side of dentistry. His comprehensive plan will organize your personal and professional finances so you can focus on taking care of patients. Massive ROI.

I can’t say enough good things about everyone at PracticeCFO. Everyone on the team is professional, organized, knowledgeable, helpful and kind. They also respond to emails and phone calls immediately and are always happy to help. They have helped me navigate year-to-year as a business owner. PracticeCFO gives me peace of mind that my business is in good hands.

I love Practice CFO! They have helped me obtain a practice and maintain a practice. They are incredible people who are on top of everything and make owning and running the business portion of a practice easy. They couldn’t be better for my business and my sanity. They have every detail of the business and taxes taken care of where all I have to do is show up and follow their easy steps to success!

Practice CFO has the best tools I’ve seen for personal tax and financial planning in addition to top-tier corporate tax and accounting services. I have been very pleased with the level of quality service. They manage my monthly bookkeeping and accounts payable. It is a great system and saves me a ton of time, and it allows us to have monthly financial statements within a week of month end.

This will close in 0 seconds